tax strategies for high income earners 2021

We may see some compromise come out of the Hill but still all indicators point to higher income earners bearing the grunt. Contact a Fidelity Advisor.

Tax Strategies For High Income Earners Wiser Wealth Management

Our Resources Can Help You Decide Between Taxable Vs.

. It was founded in 2000 and has. For high-income earners charity contributions often generate more tax savings compared to low-income earners. Its called HAS and many high-income people dont utilize the plan or use it incorrectly.

Not everyone is eligible. This is one of the most basic tax strategies for high income earnersthat you can take advantage of. A donor-advised fund DAF is an investment account created to.

Tax Strategies for High Earners. The prospect of higher income taxes is real. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden.

How to Reduce Taxable Income. Max out your retirement plan contributions. Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Max Out Your 401k The contribution limit for an individual in 2021 is. Ad 6 Often Overlooked Tax Breaks You Dont Want to Miss.

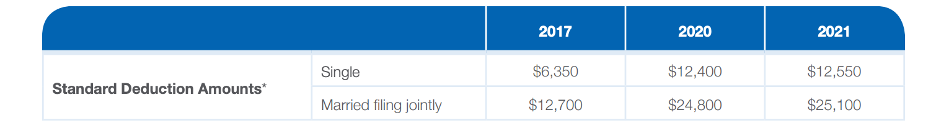

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Many high-net-worth taxpayers are creating new plans now and waiting to sign them pending the outcome of tax proposals according to Wolberg. Despite the increases of the standard deduction limits in recent years it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions.

If youre a high-income earner wanting to reduce your taxable income start with these five strategies. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

Preparing a strategy and formulating a financial plan is key to being prepared. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. 6 Tax Strategies for High Net Worth Individuals.

July 1 2021 Insights. One of the easiest ways to begin slashing your annual income tax bill is by contributing to a retirement. Year-Round Tax Reduction Strategies For High-Income Earners.

Here are some of things you can do now to keep from overpaying. If your income was higher in 2021 can reduce your income by adding to retirement plans making large business purchases this year for depreciation making charitable. If you wish to save tax money it is better to contribute to a savings account or health plan.

5 Tax Strategies For High Income Earners. Here are a few smart tax strategies to incorporate in the course of 2021. The top rate for 2021 applies to individuals earning more than.

Tax Filing Status. In 2021 the employee pre-tax contribution limit. Contributing to a Health Savings Account HSA is a way for high earners to get a tax deduction now and take tax-free distributions to pay for qualified medical expenses.

Learn More at AARP. The contribution you will make will come straight out of your. For example the 2021 contribution limit for.

Health Savings Account Investing. Consider a 500 donation from a high earner in the 37 tax bracket and a. In general the more you can save in a retirement vehicle up to the allowable limits the more you can usually save long-term on taxes.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. You Might Be Able to Turn That Tax Bill into a Refund. Specifically contribute to a traditional 401k or IRA.

Family Income Splitting and Family Trusts. 50 Best Ways to Reduce Taxes for High Income Earners. 1 Invest in retirement accounts.

Just as it sounds this option. Due to the pandemic and stimulus payments the federal governments tax filing season for individual. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs. Dont discount the wealth-generating potential and flexibility an HSA can afford. About the Company Some Tax Relief Measures Used By High Income Earners.

CuraDebt is a company that provides debt relief from Hollywood Florida. Single and head of household filers covered by a workplace retirement plan. It works by setting up a.

Tax Strategies For High Income Earners Pillar Wealth Management

5 Outstanding Tax Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Taxry

The Hierarchy Of Tax Preferenced Savings Vehicles

High Income Earners Face Tax Scrutiny Under American Families Plan

Tax Strategies For High Income Earners Pillar Wealth Management

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Tax Strategies For High Income Earners Pillar Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

Top 10 Pros And Cons Of Instagram Business Account Instagram Business Instagram Business Account Business Account

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Tax Strategies For High Income Earners Wiser Wealth Management